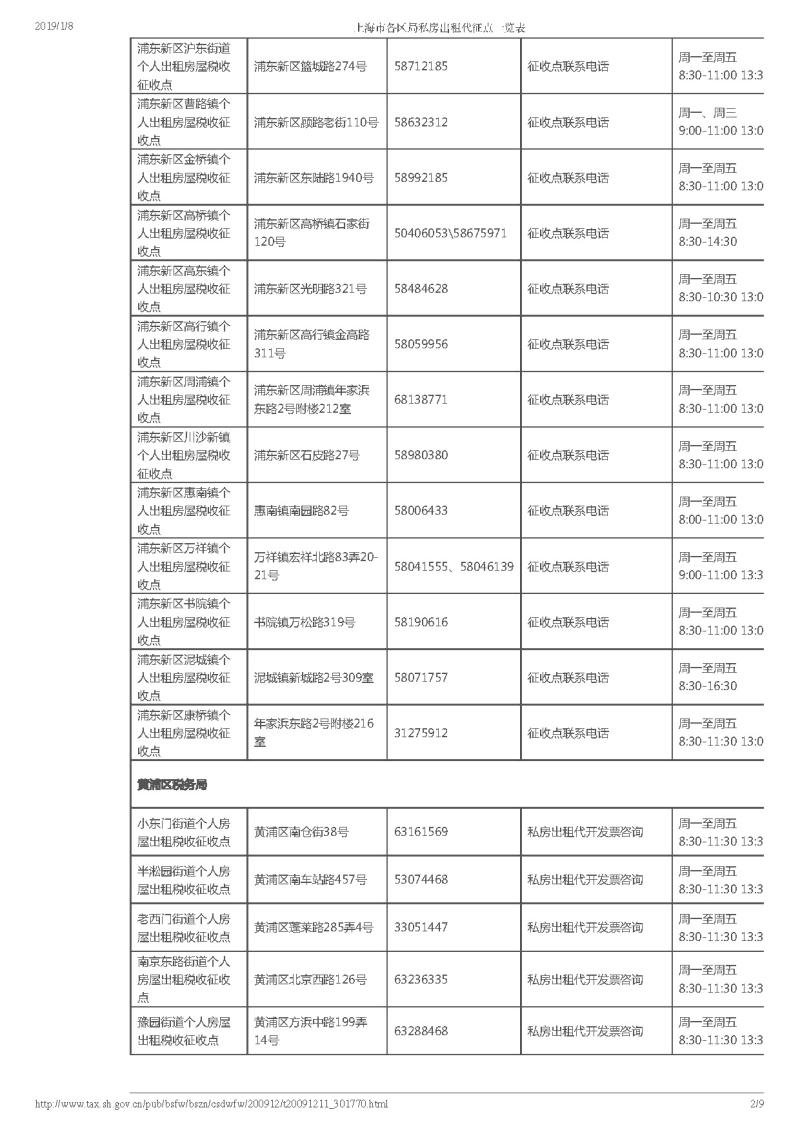

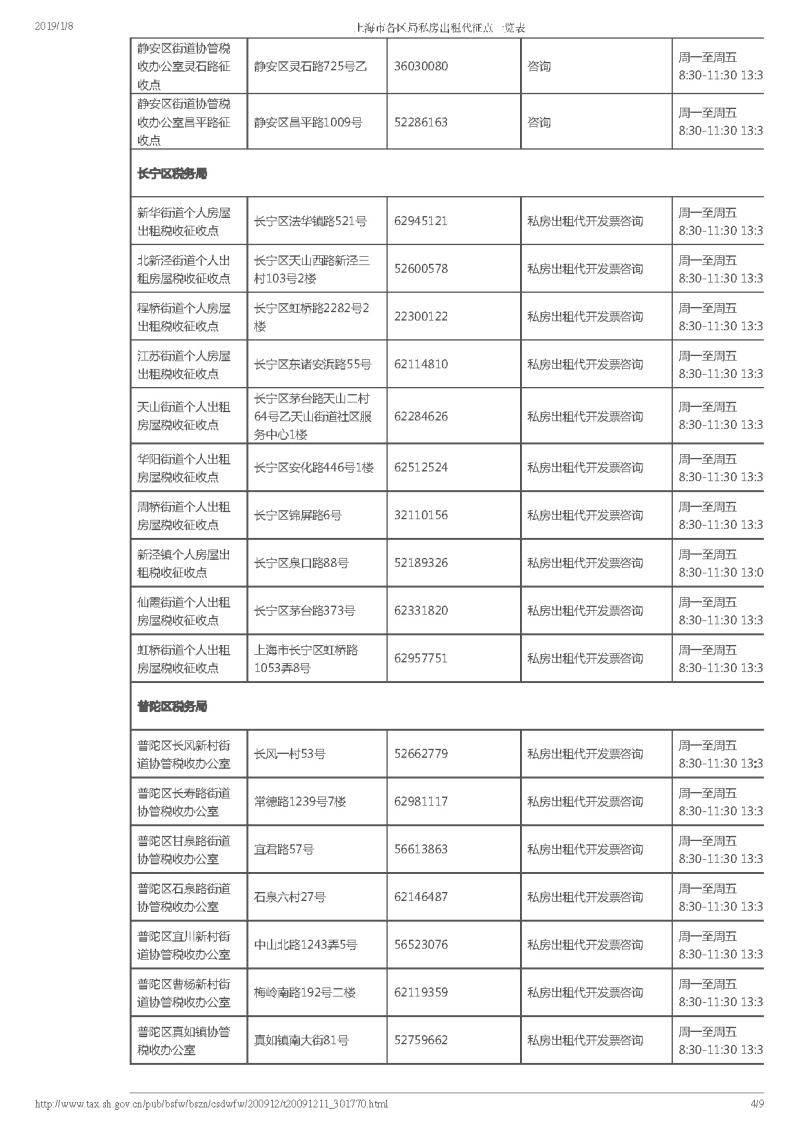

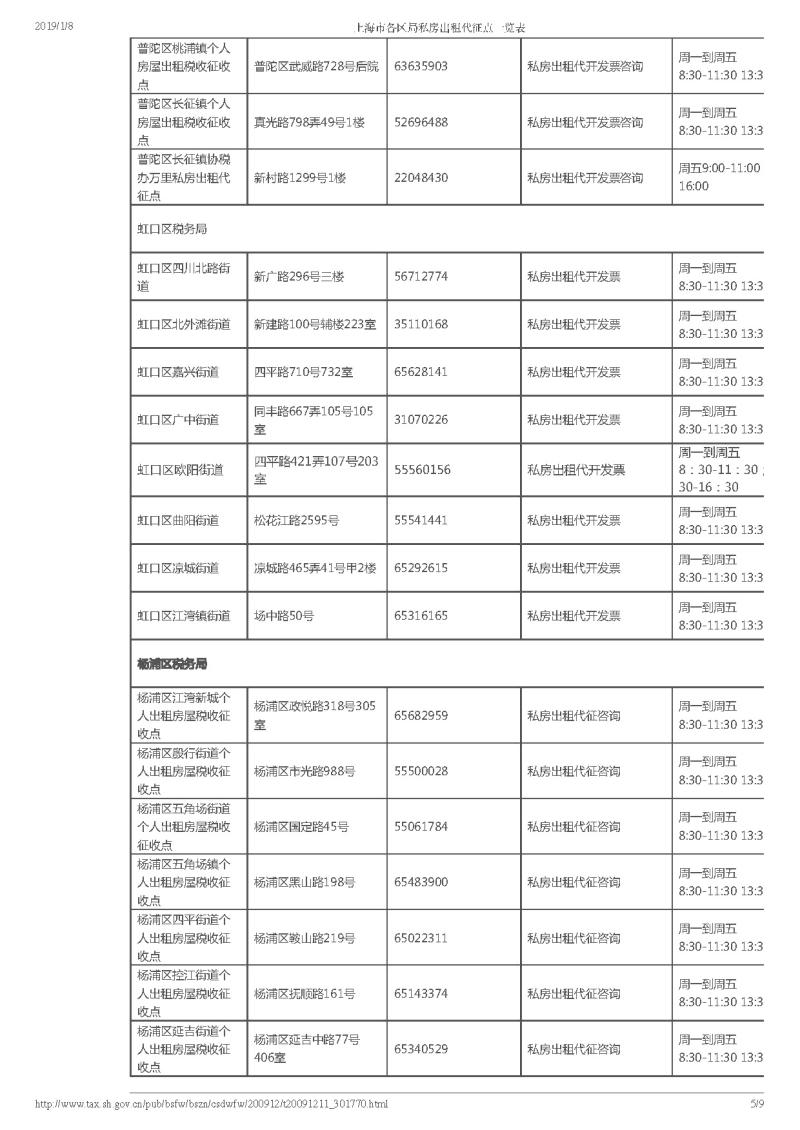

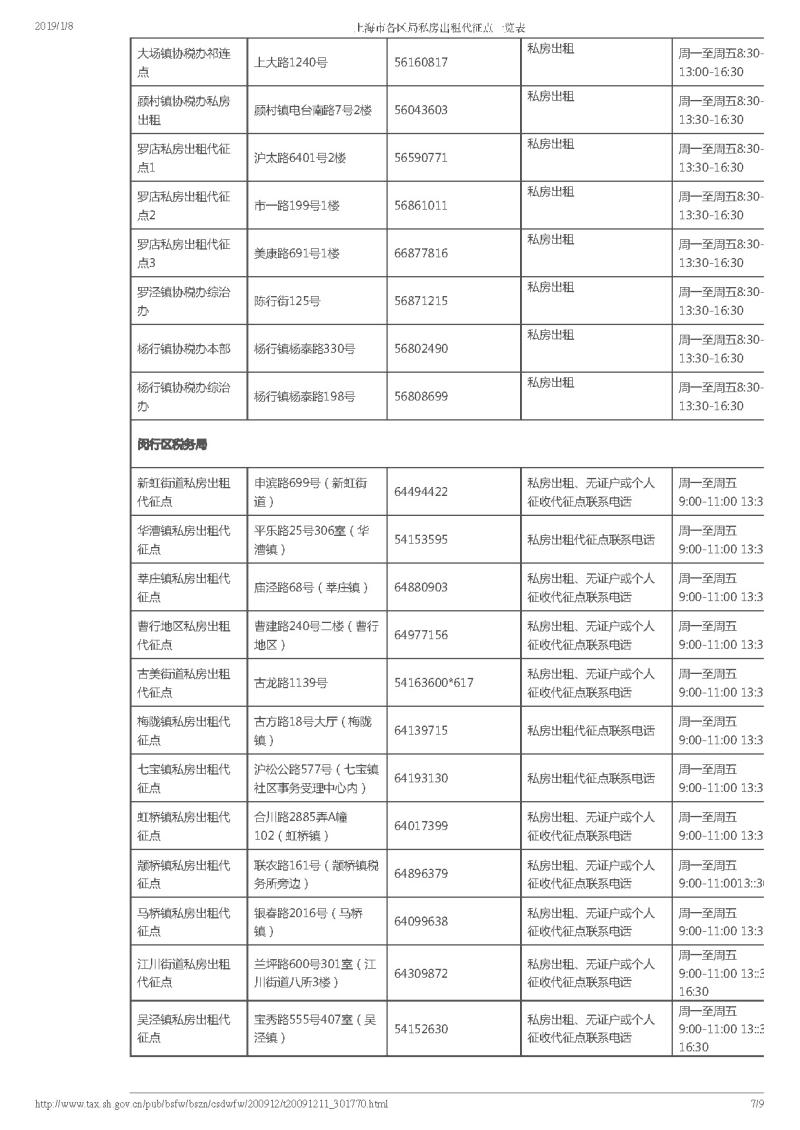

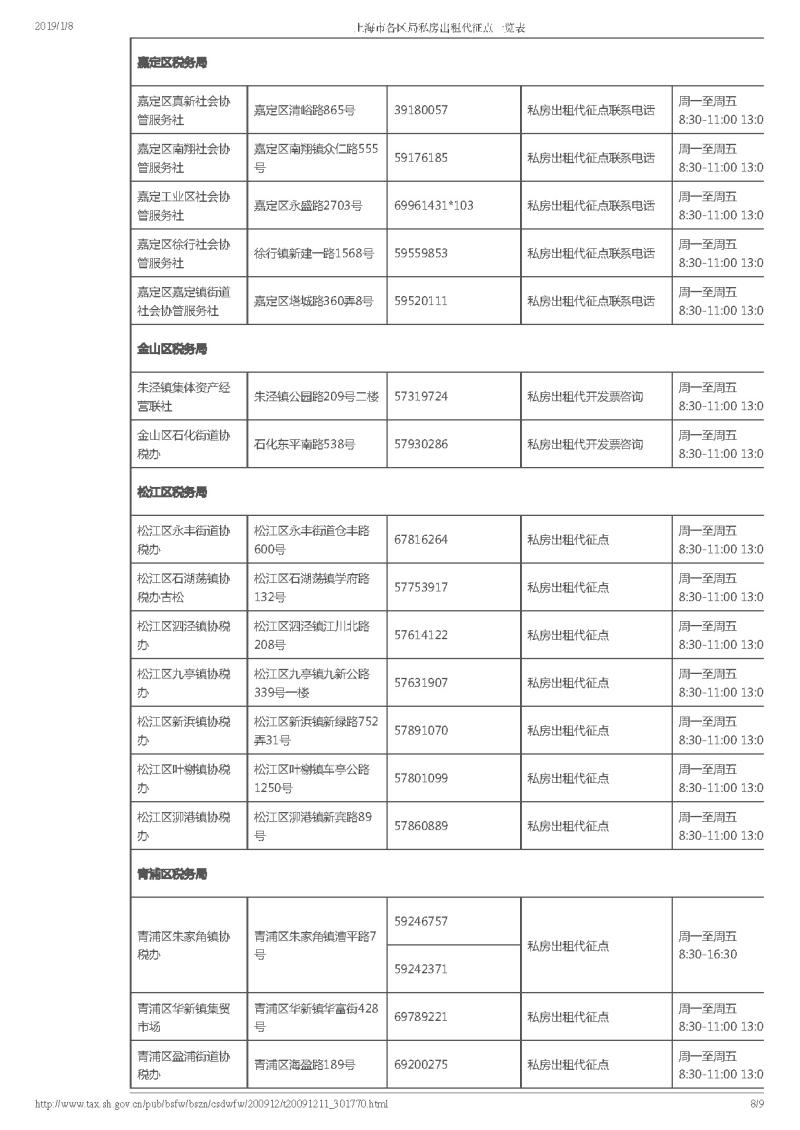

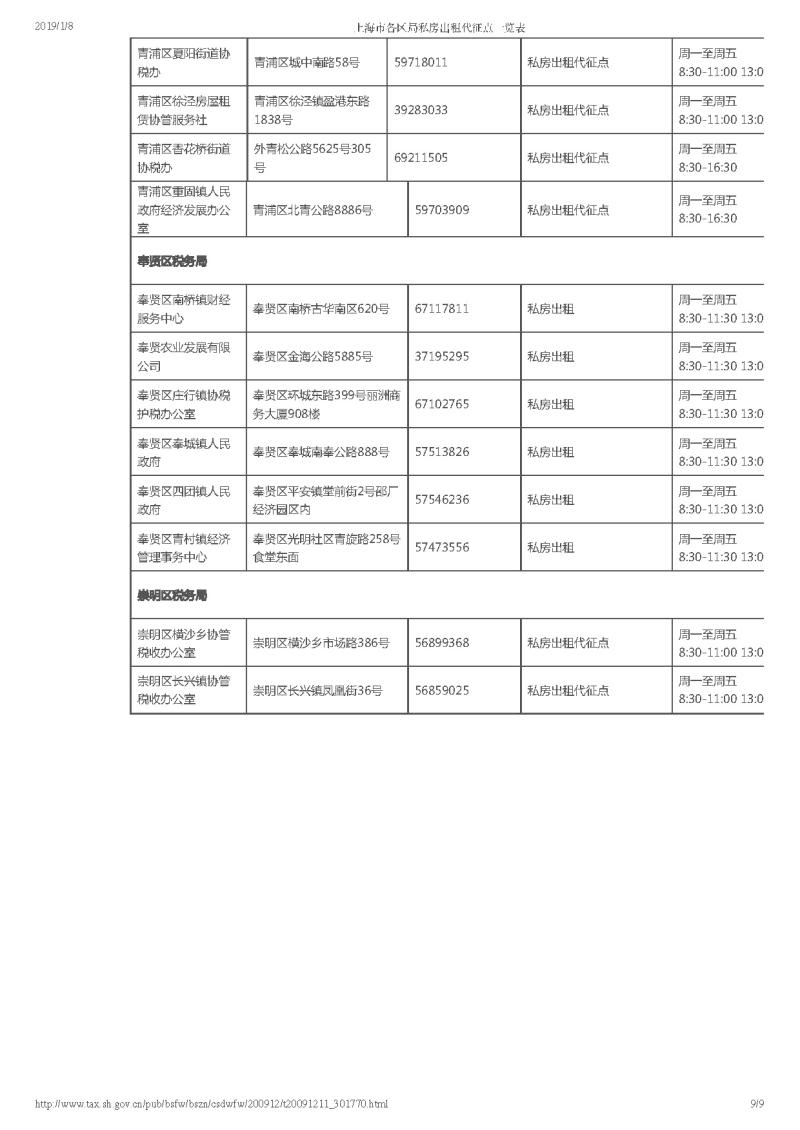

上海:住房租金計稅收入3萬以下綜合稅率為3.5%,由代征點征收

來源:上觀2019.1.8

摘要:上海目前私房出租的稅款由各區的私房出租代征點代為收取,需納稅人自覺自愿前往。

更多資訊

-

上海開建全周期金融科技人才認證培育體系,首批人才創新實踐基地亮相2023.5.25

全球金融科技師CGFT項目影響力不斷提升。 上海建設金融科技中心迎來新助力。在5月24日舉行的2023年首屆特許全球金融科技師CGFT大會上,《全周期金融科技人才認證培育體系標準1.0白皮書》、首批全… 查看詳情 >

-

又一里程碑“互換通”來了,香港與內地金融衍生品市場打通2023.5.16

受到境外投資者熱烈歡迎。 香港與內地金融市場互聯互通機制再迎里程碑。今天(5月15日),“互換通”正式上線,香港與內地金融衍生品市場互聯互通機制正式開通,初期先行開通“北向互換通”,可交易品種為利率互… 查看詳情 >

-

浦發銀行為先正達集團落地FT項下流貸銀團 助力農化企業賦能鄉村振興2023.5.11

為國家基石戰略貢獻金融力量。 日前,浦發銀行以聯合牽頭行身份為先正達集團成功落地FT項下流動資金銀團貸款。借助該行專業高效的自貿、投行服務,有效降低企業融資成本,更助力企業持續賦能鄉村振興。 先正達集… 查看詳情 >

-

授信超1200億元,涉及30家民企,央行上海總部和上海市工商聯一起出手了2023.4.20

30家民企具有較強的代表性和示范性。 4月18日,人民銀行上海總部、上海市工商聯聯合舉辦了民營企業與商業銀行對接暨集中授信簽約活動。此次活動是人民銀行上海總部和市工商聯正在組織開展的“金融支持民營經濟… 查看詳情 >